Team

Ana Soto

Evan Knowles

Jonathan Palacio

Professor

Xènia Viladàs

Project

Savannah College of Art & Design

Opportunity

More than 51 million American households remain unbanked or underbanked.

The large majority of the unbanked and underbanked demographic rely on predatory alternative financial services (e.g. payday/title loans and check cashing services) to secure emergency loans, which can have interest rate of excess of 300%.

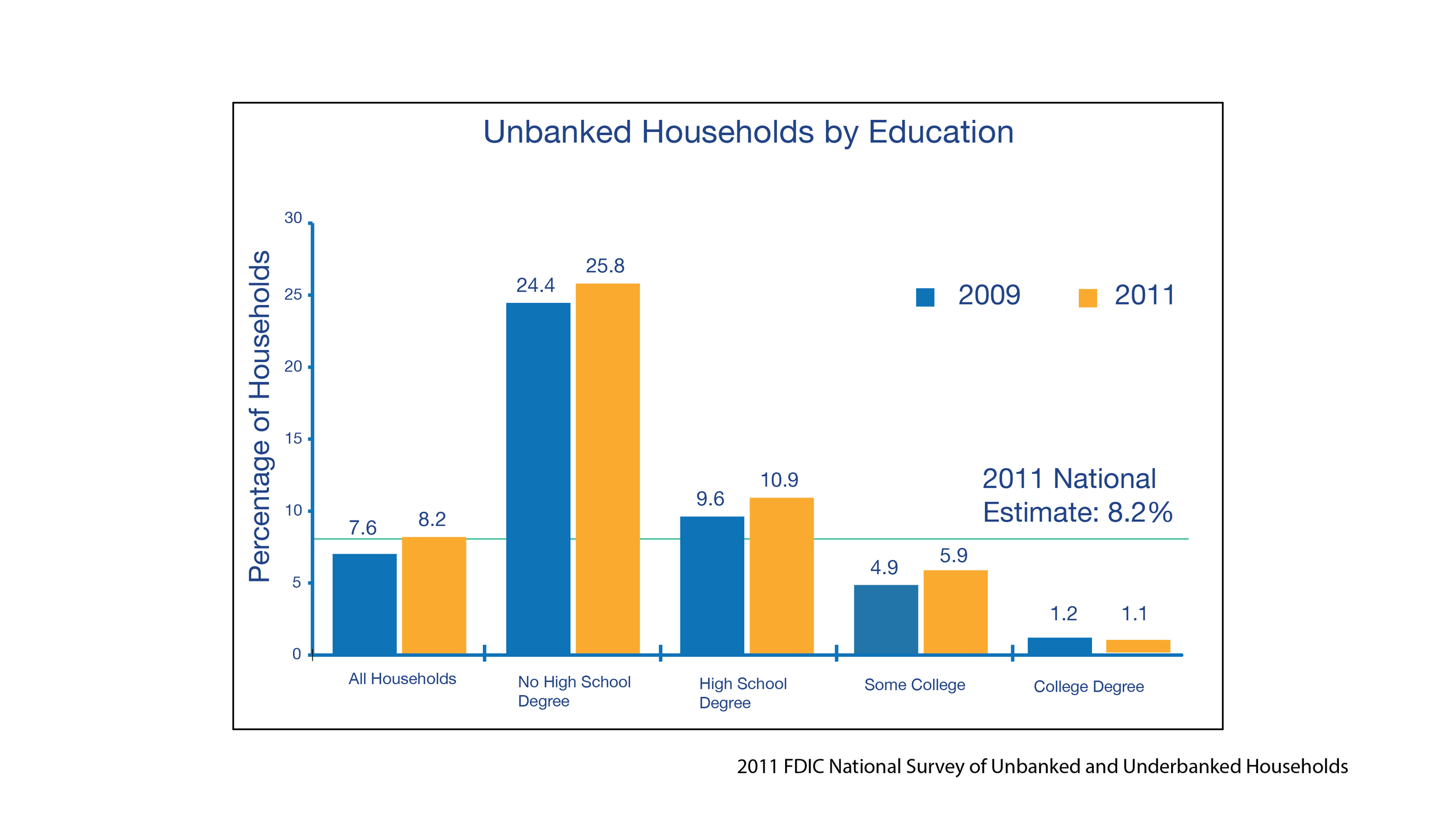

Research suggests that a general lack of education about banking and credit is a large contributing factor to their circumstances. In addition, a large percentage of this market is considered high risk by conventional banking institutions because of their poor credit history in banking.

Solution

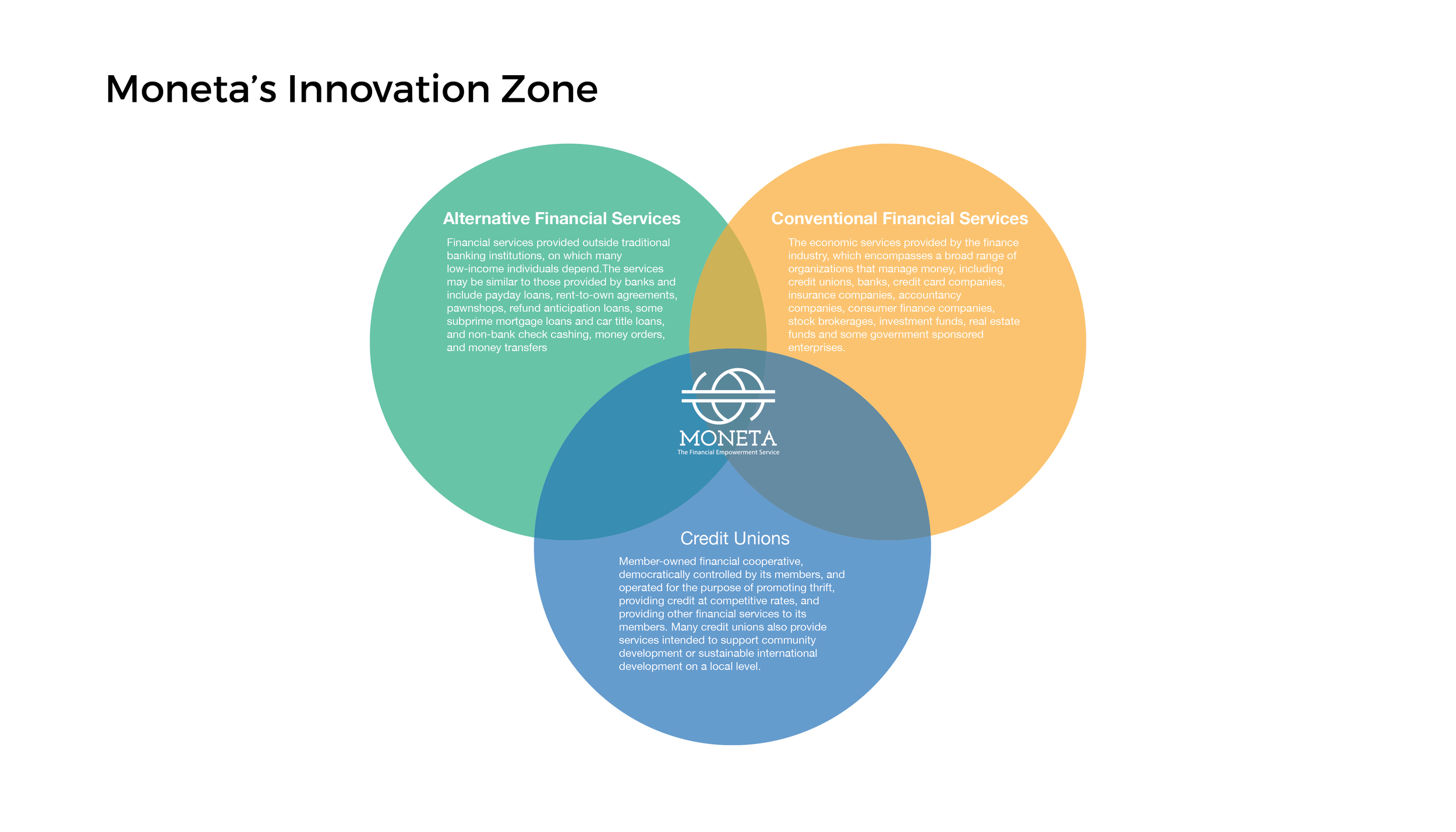

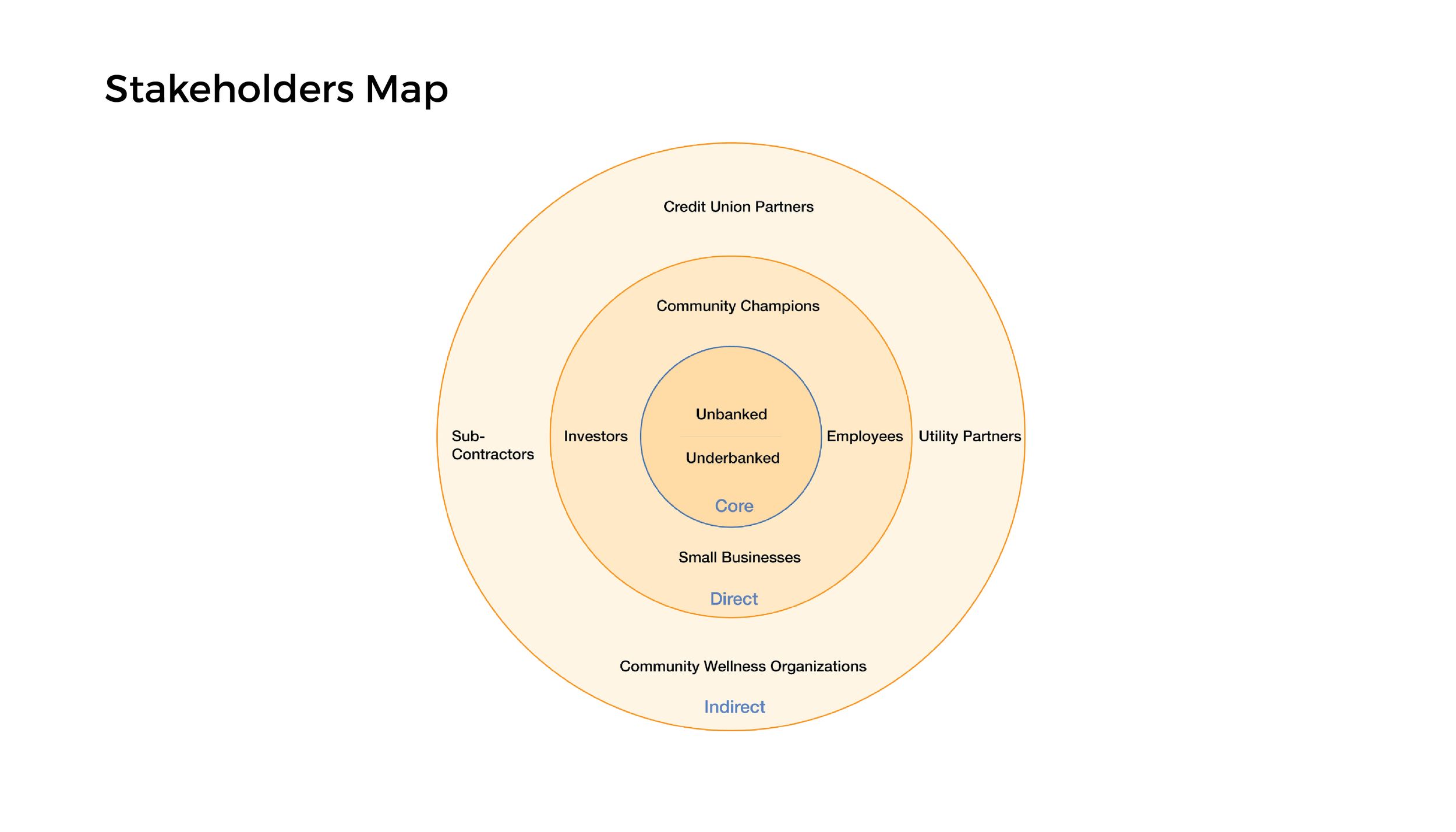

Community and transparency drive social innovation for Moneta while increasing value and trust in offerings and facilitating sustainability and growth.

Through transparent practices and an educational platform Moneta seeks to educate its users while encouraging confidence in its service offerings. As an NPO, 501(c) Moneta is structured to empower users and focus on their benefit rather than strictly profiting shareholders. Investors and partners play a pivotal role in triggering virtuous economic cycles in the communities that adopt Moneta.

Finding the Opportunity

Moneta began as a project for a Service Design class at Savannah College of Art and Design (SCAD), SERV421: Service Enterprise. The initial brief for the course was to deliver a new to the world service with a deliverable of an actionable business plan.

Research Methods

Our research consisted of three main parts:

Target Audience research: understanding the user's needs.

Business environment research: current service offerings.

Meeting with non-profit organizations in Savannah to further expand insights about the users and their environment.

Target Audience Research

Unbanked Users

The Unbanked population is a diverse groups of individuals who remain outside the banking mainstream for many reasons. The term unbanked means that a person does not have a checking or savings account.

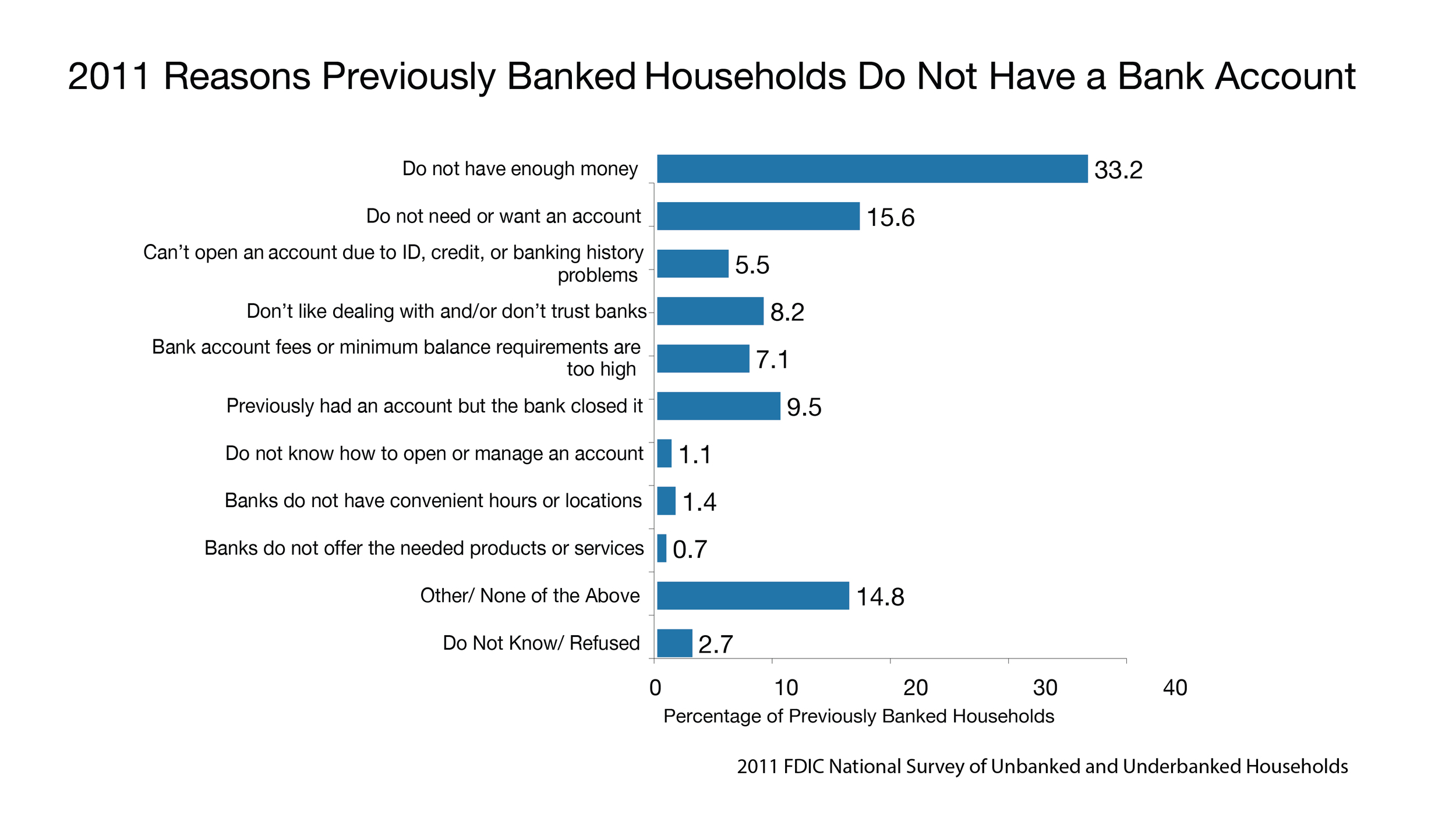

People are unbanked for many reasons including:

Lack of understanding about the banking system and expectations for having a bank account

Past negative banking experience

Lack of appropriate identification and/or documentation needed to open a bank account

Unstable living situation

Cultural conflict including bank practices that vary with personal beliefs.

Underbanked Users

The groups of individuals with insufficient access to financial services. Underbanked consumers have a checking account and may also rely on alternative financial service like payday lenders and check cashing services. Managing either a checking or savings account the underbanked mostly use mobile devices, since 70 percent have a mobile phone. The alternative financial services that the underbanked may use are predatory and maintain their customers in a vicious cycle of economic instability.

" [The unbanked and underbanked] are more likely to fall victim to the high-rate predatory side of the industry, like payday, account-advance, (...), to name a few" says Mitchell Weiss, and adjunct professor of finance at the University of Hartford (Conn.)

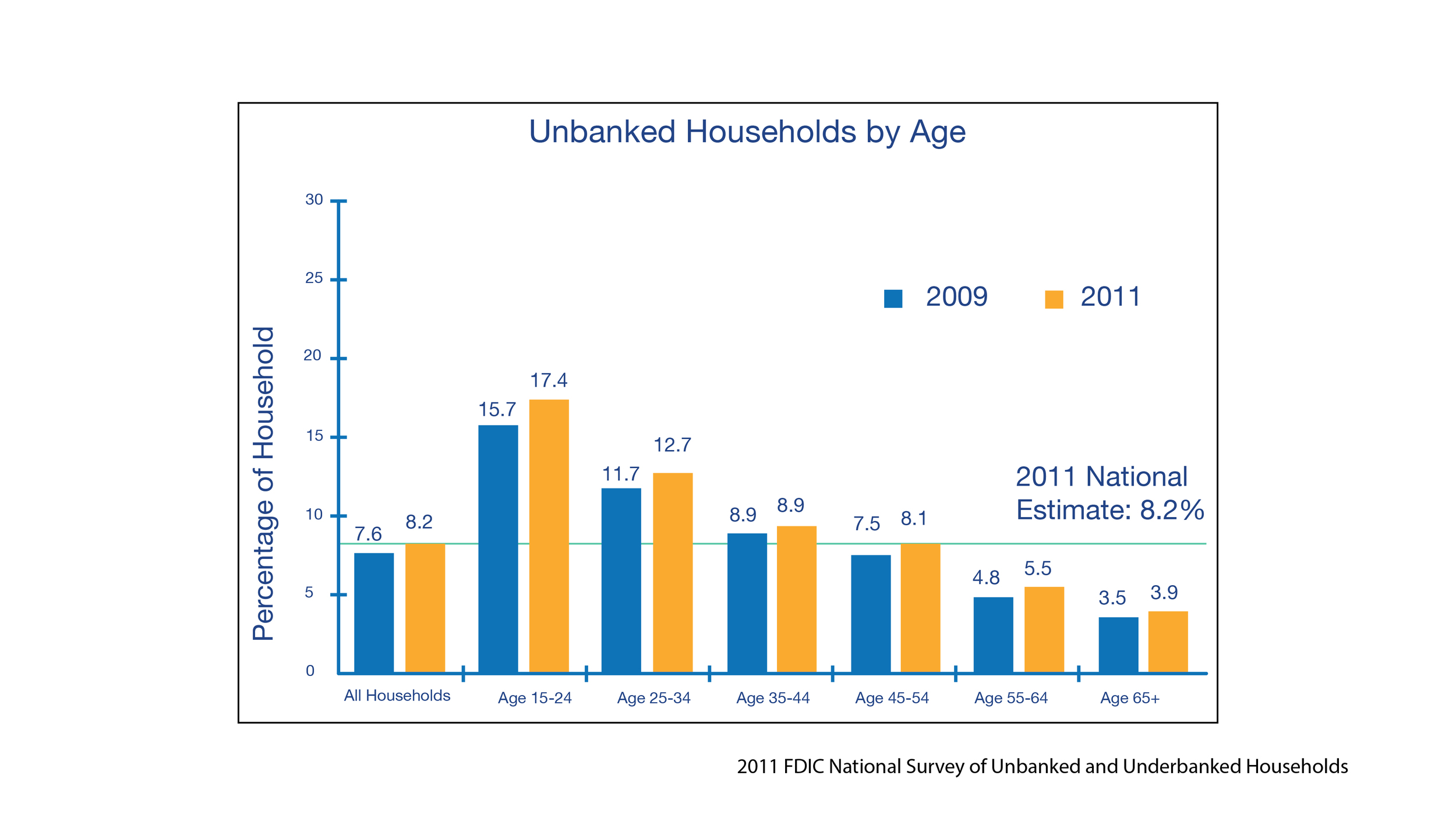

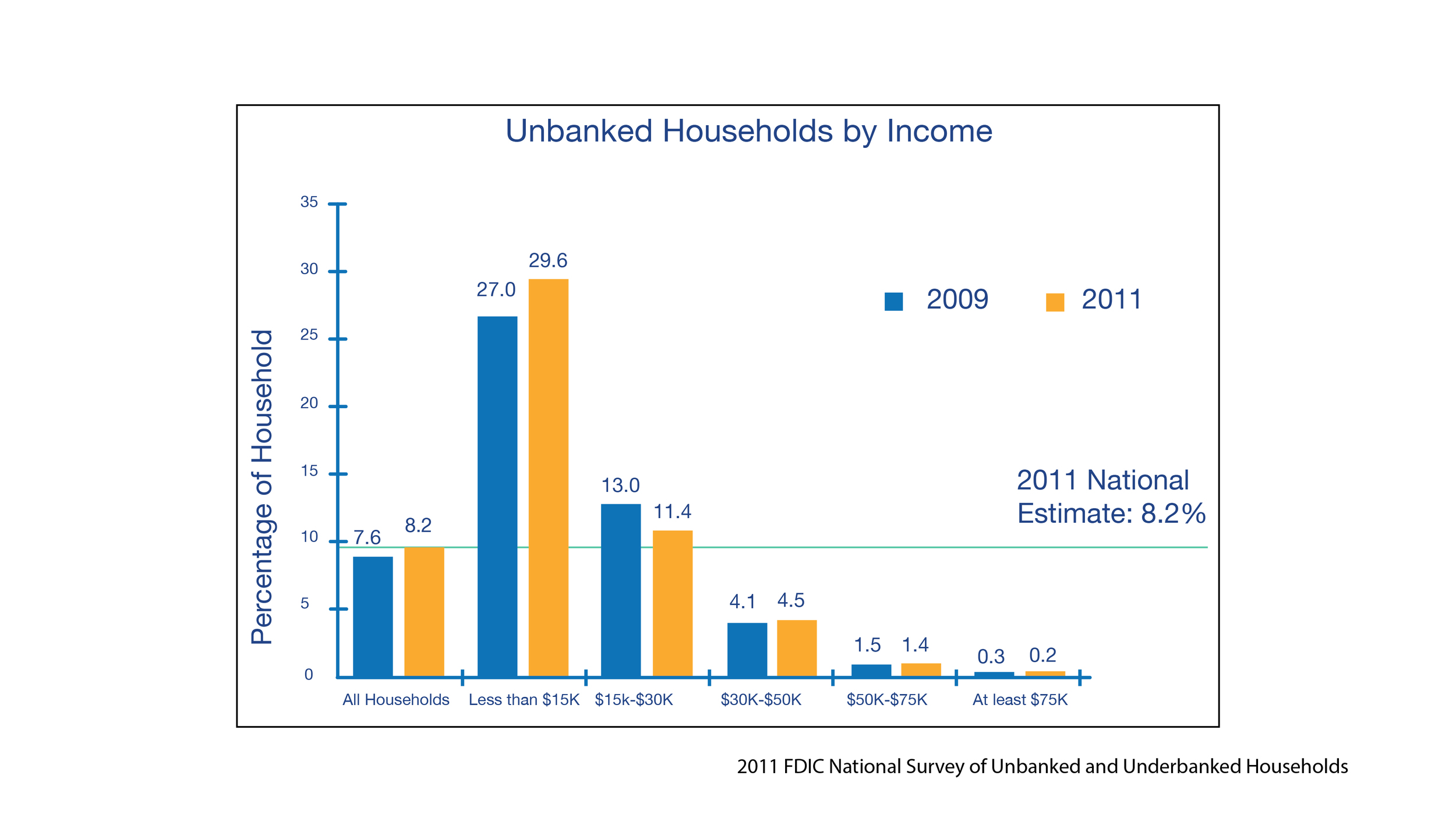

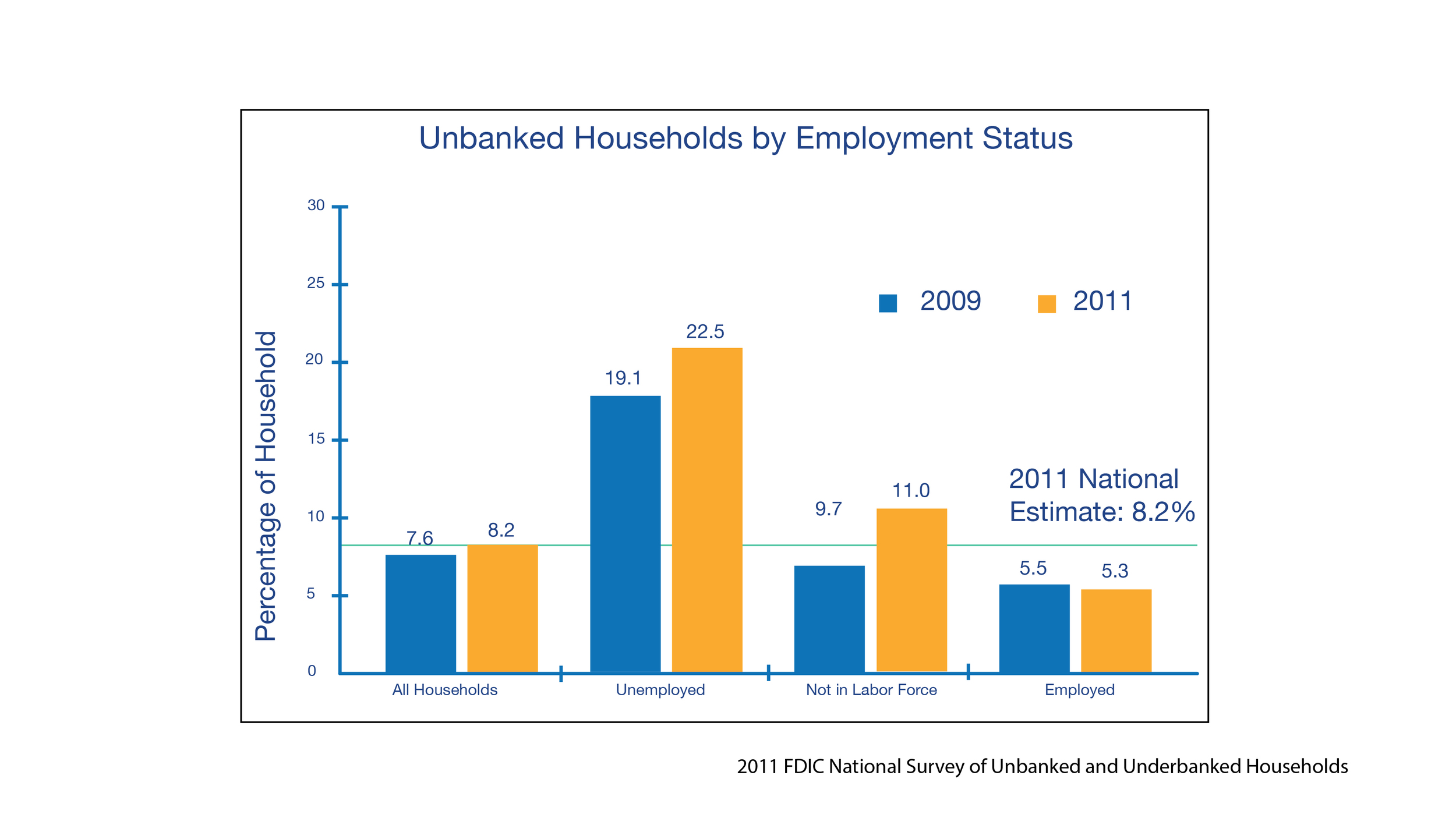

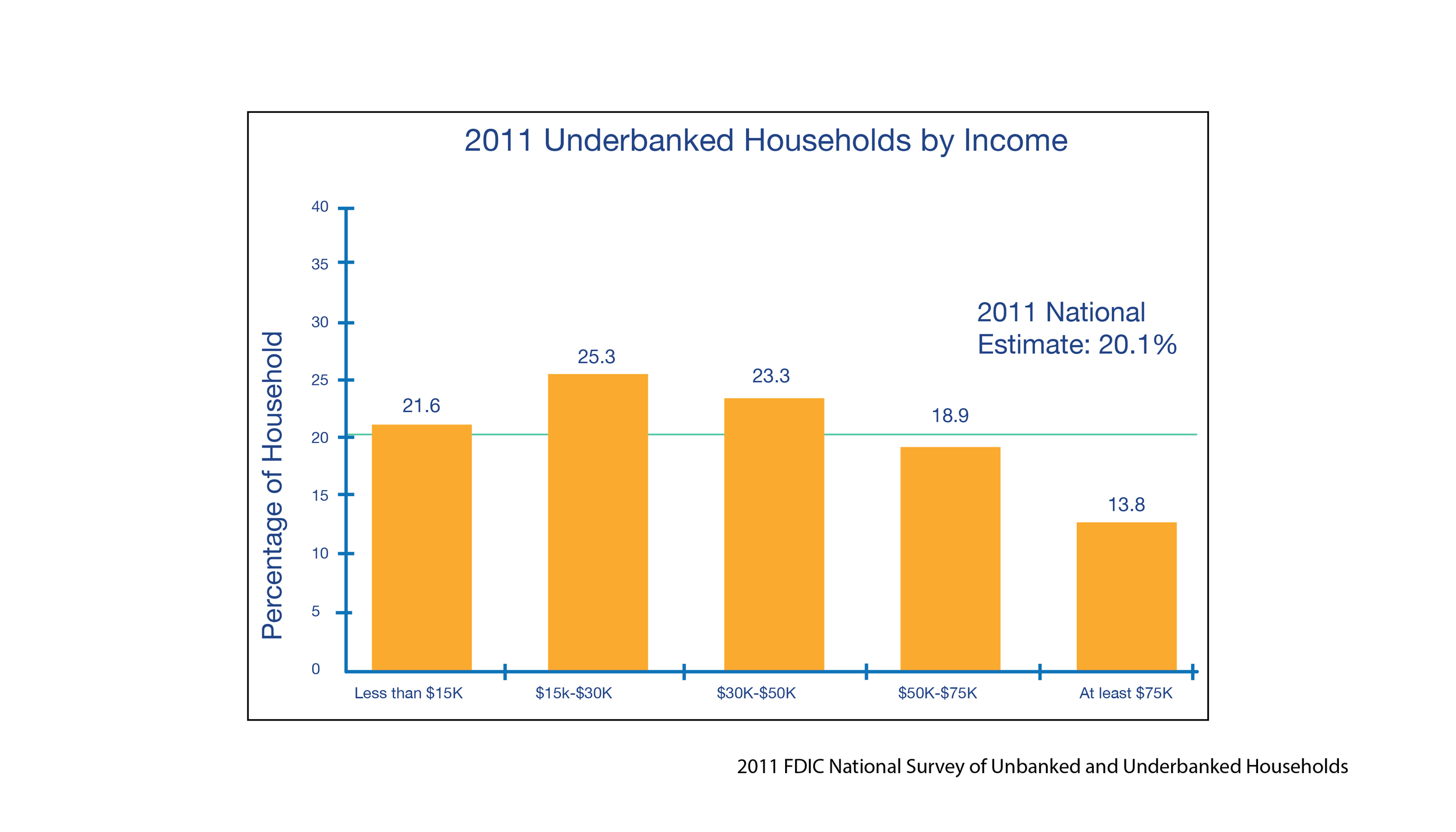

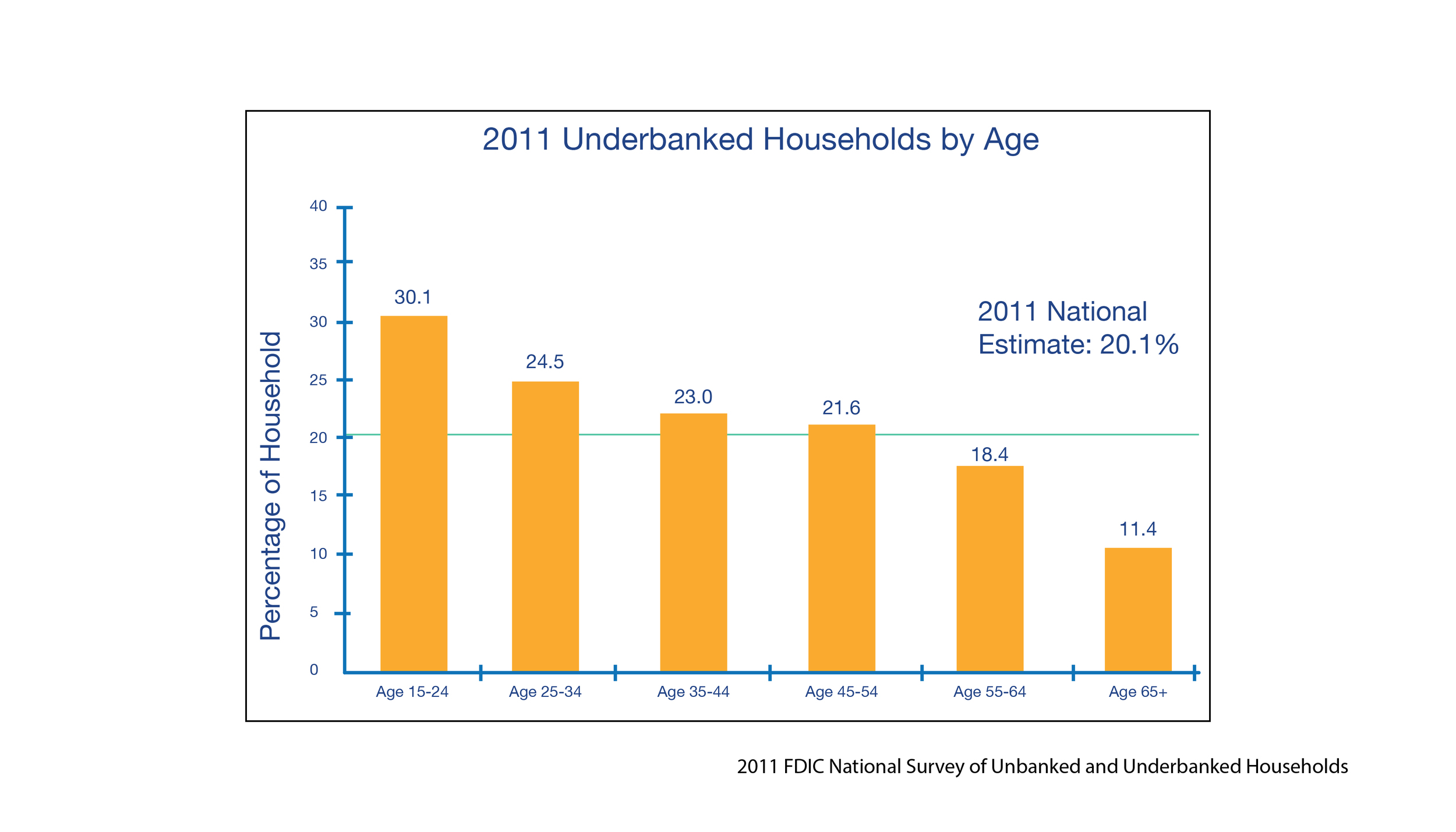

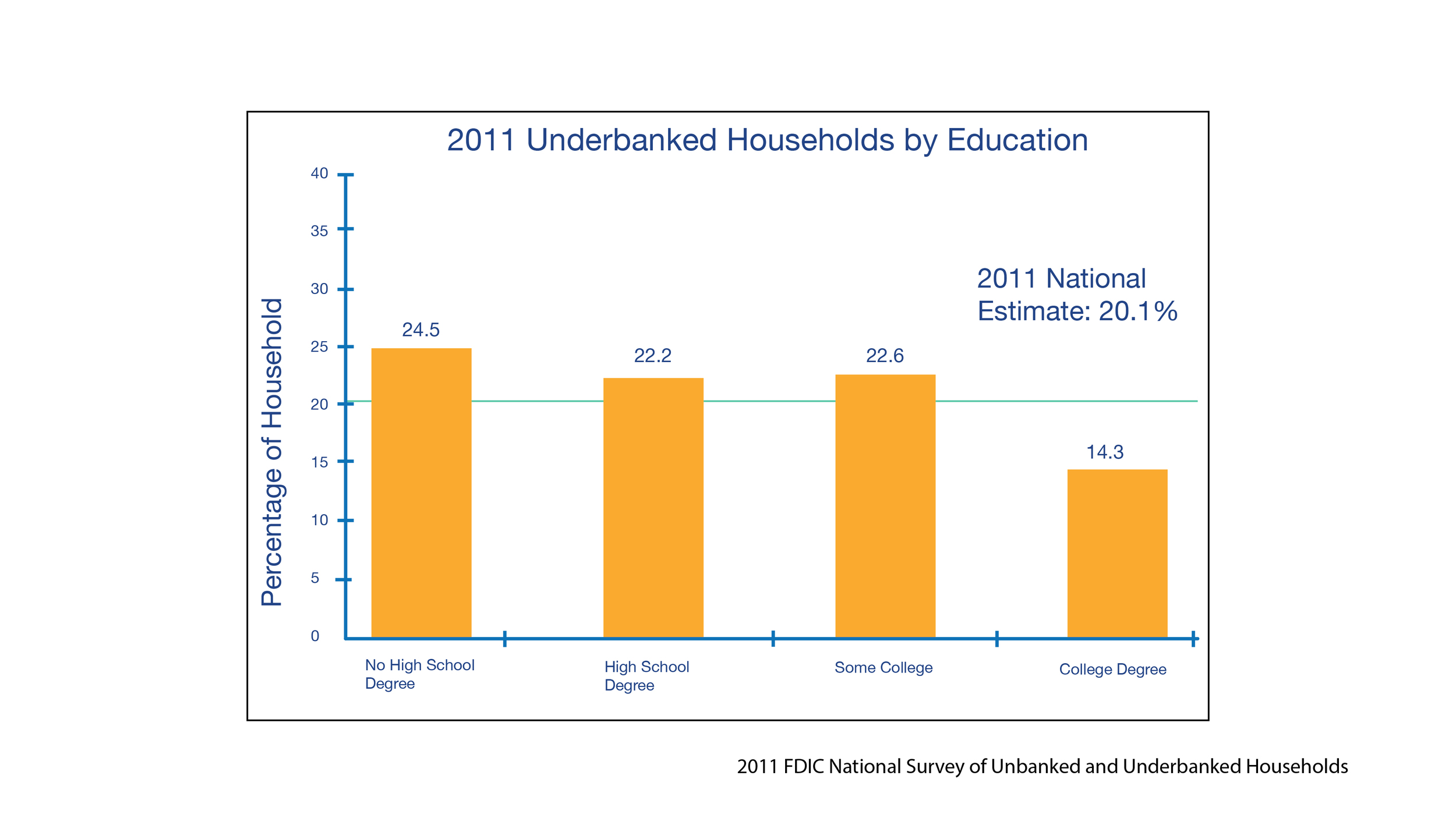

Demographic segmentation

The target market of the unbanked and underbanked share characteristics such as age, ethnicity, education levels, income and employment status. The reasons for being unbanked appear to be relatively consistent among demographic groups.

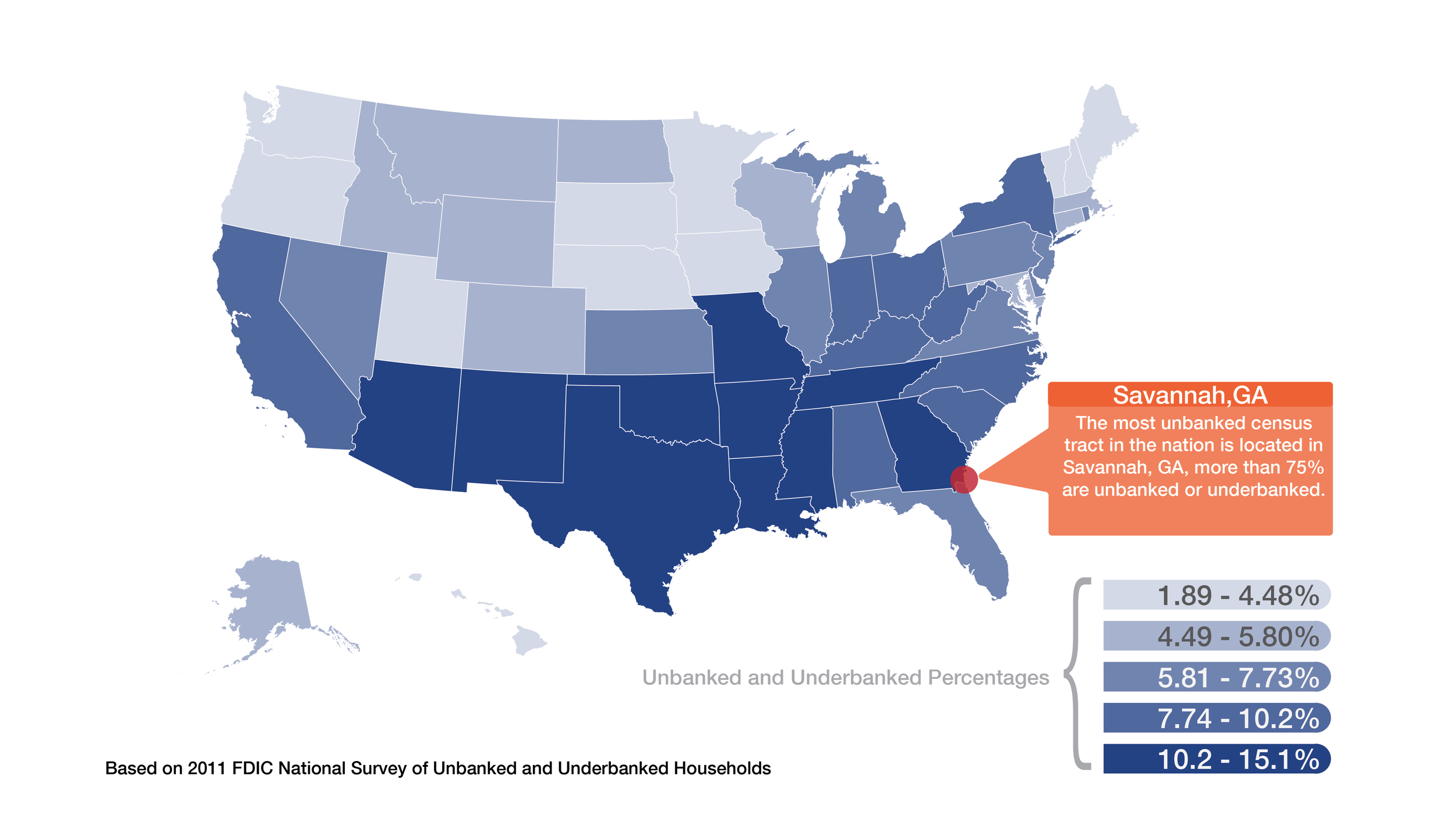

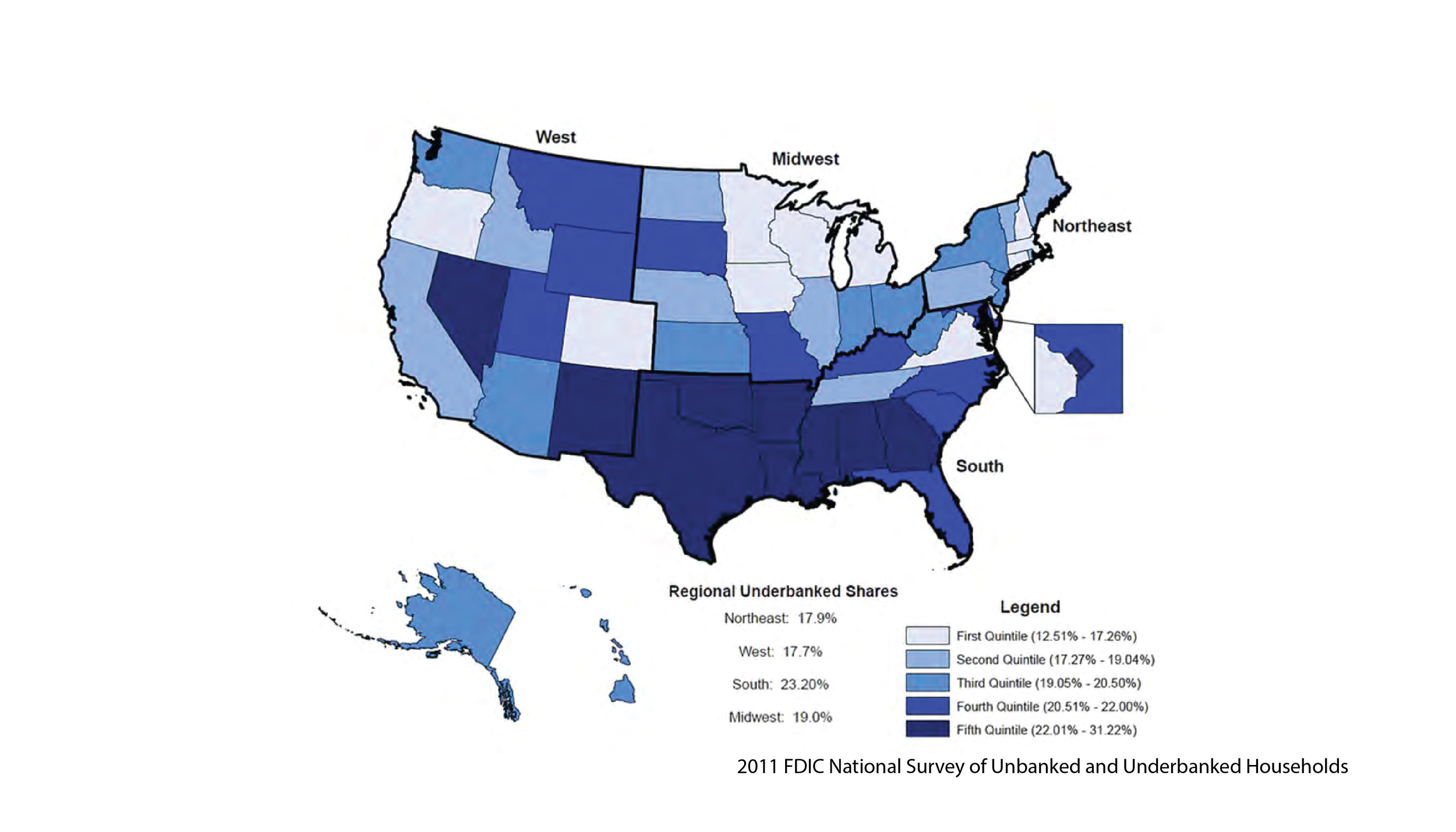

Geographic segmentation

Larger proportions of unbanked households are located in urban areas, compared to other banking status groups. The largest share of unbanked households (41.2 percent) are concentrated in urban areas, while only 30.9 percent of underbanked and a quarter (25.5 percent) of fully banked households live in urban areas.

In The United States, 17 Million adults are unbanked and 51 million adults are underbanked.

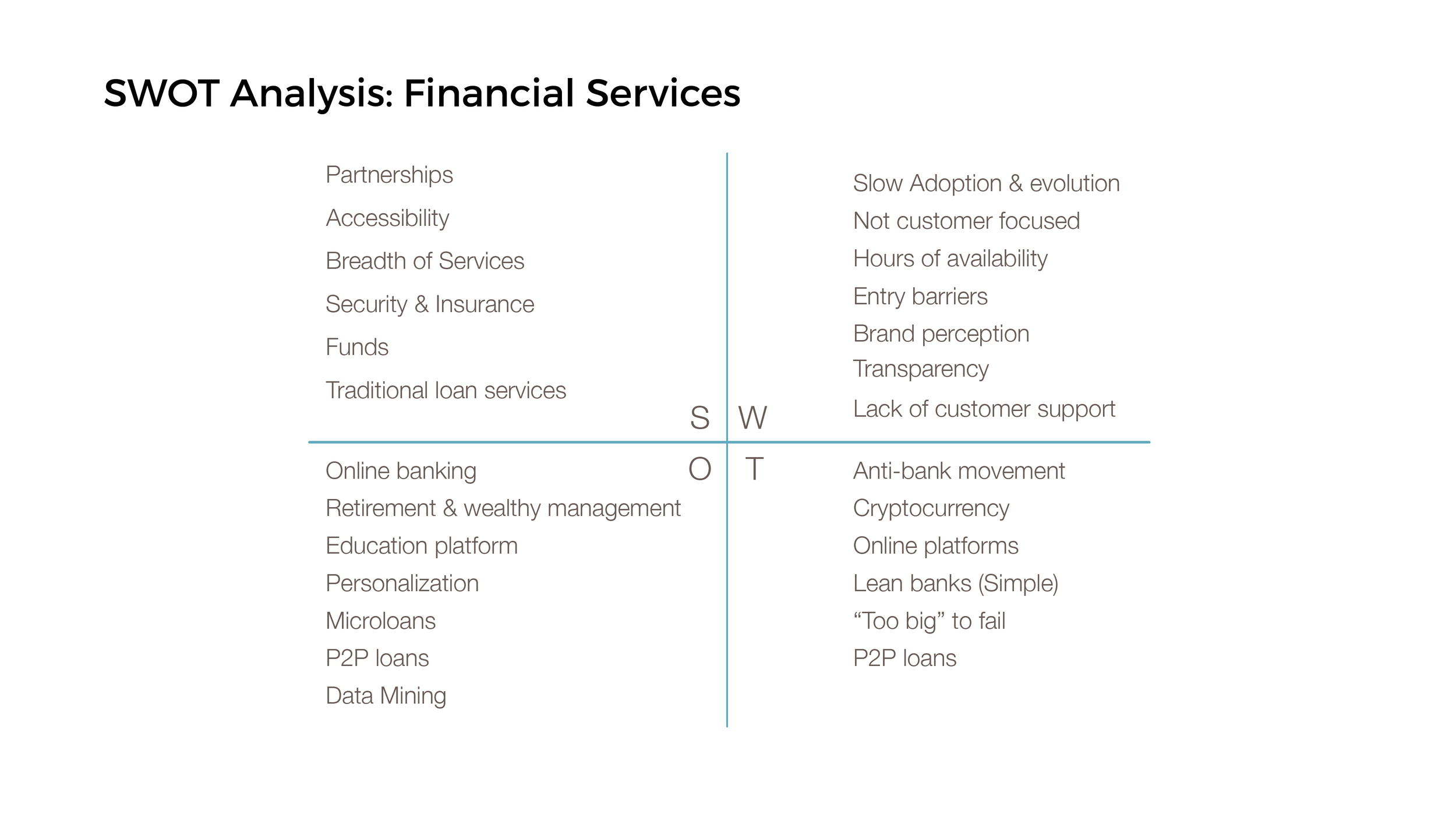

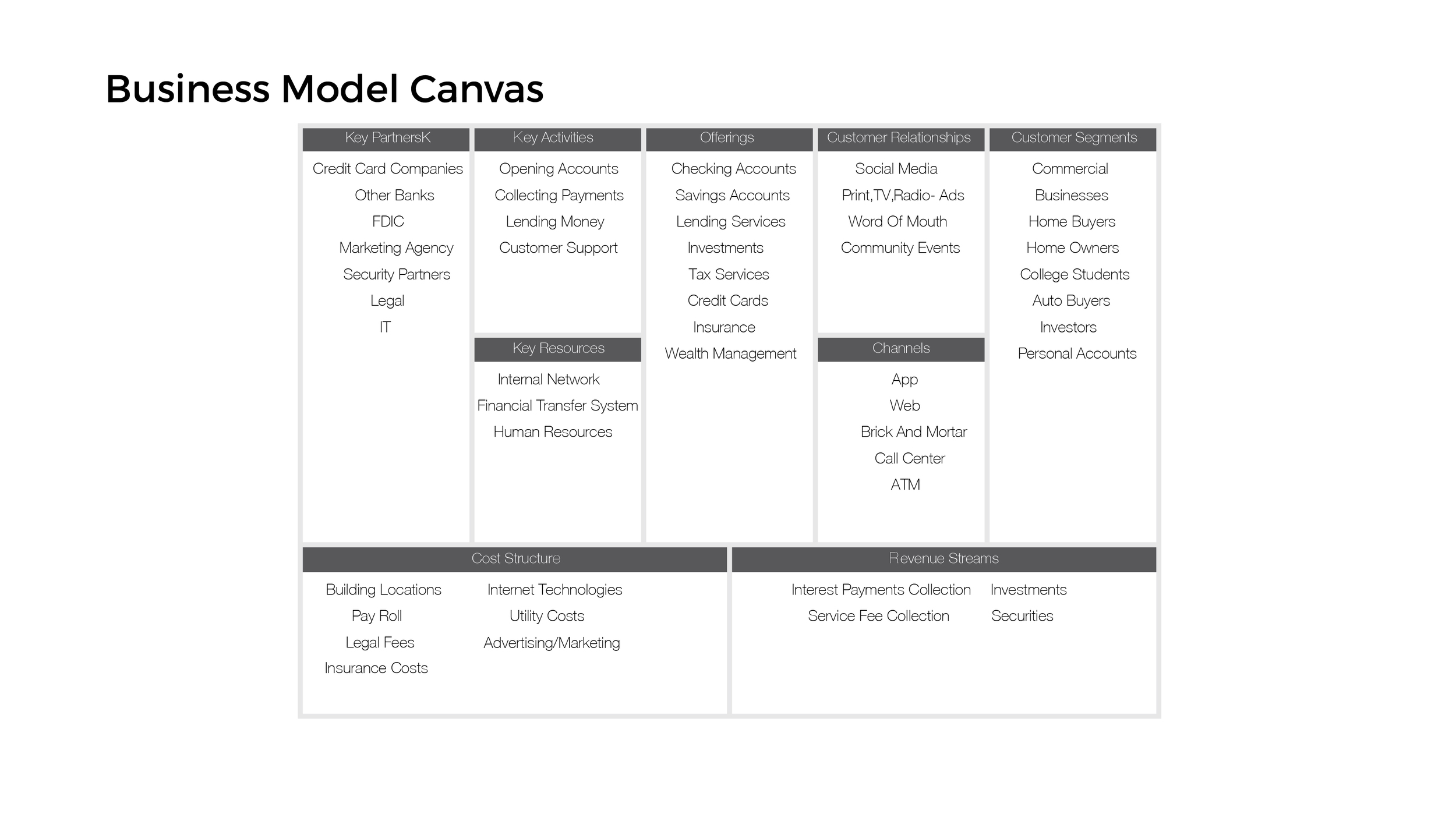

Business Environment Research: Financial Services

Financial services are offered by a broad range of organizations that manage and lend money or offer finance exchange. Some of these organization include credit unions, banks, credit card offerers among others.

Current Alternative Financial Services, such as payday loans, are nearly unregulated and predatory. They keep their users in financial struggle. AFS (Alternative Financial Service) Loans can carry interest rates in excess of 300%.

Some of the tools used to visualize research include:

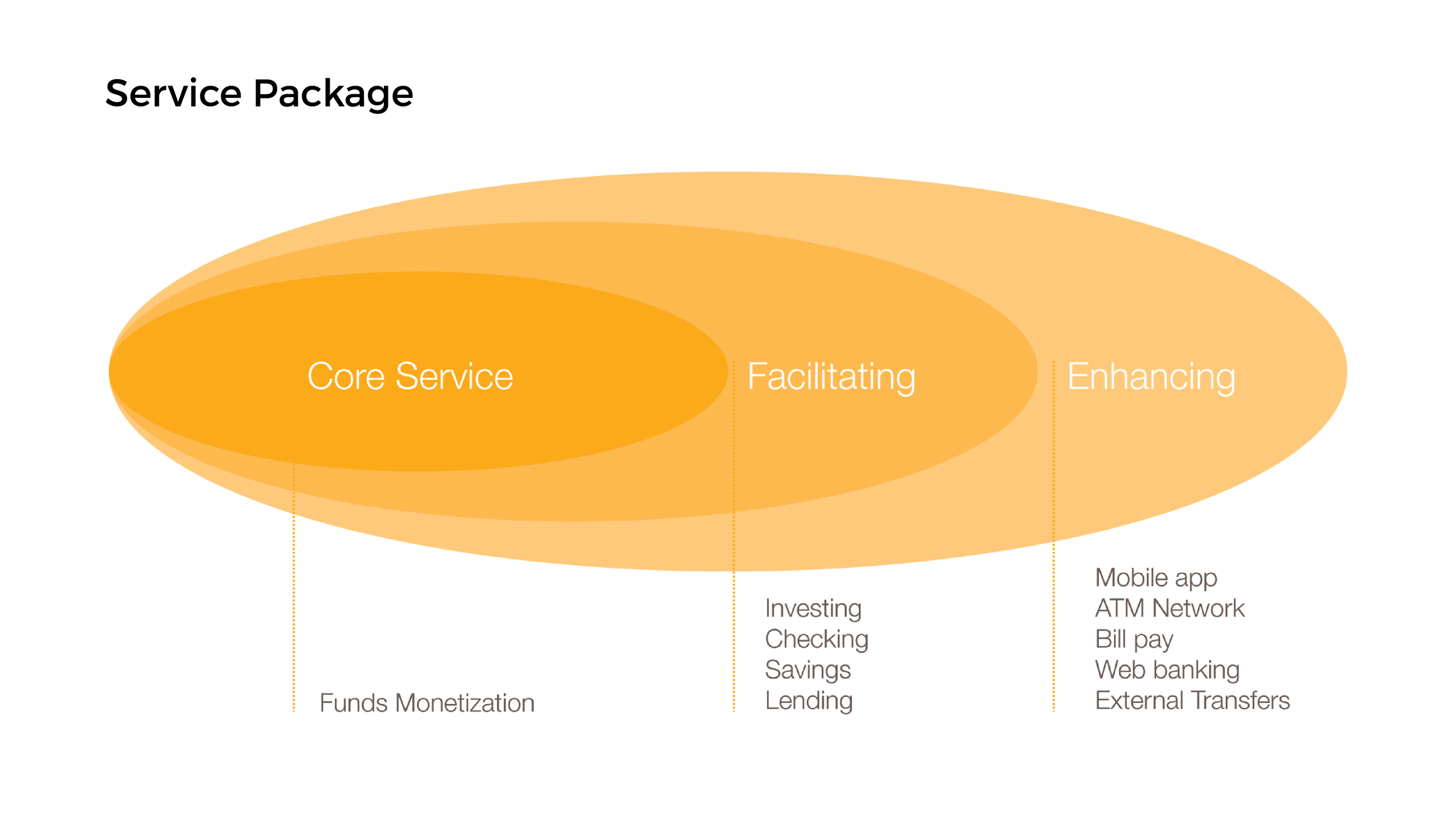

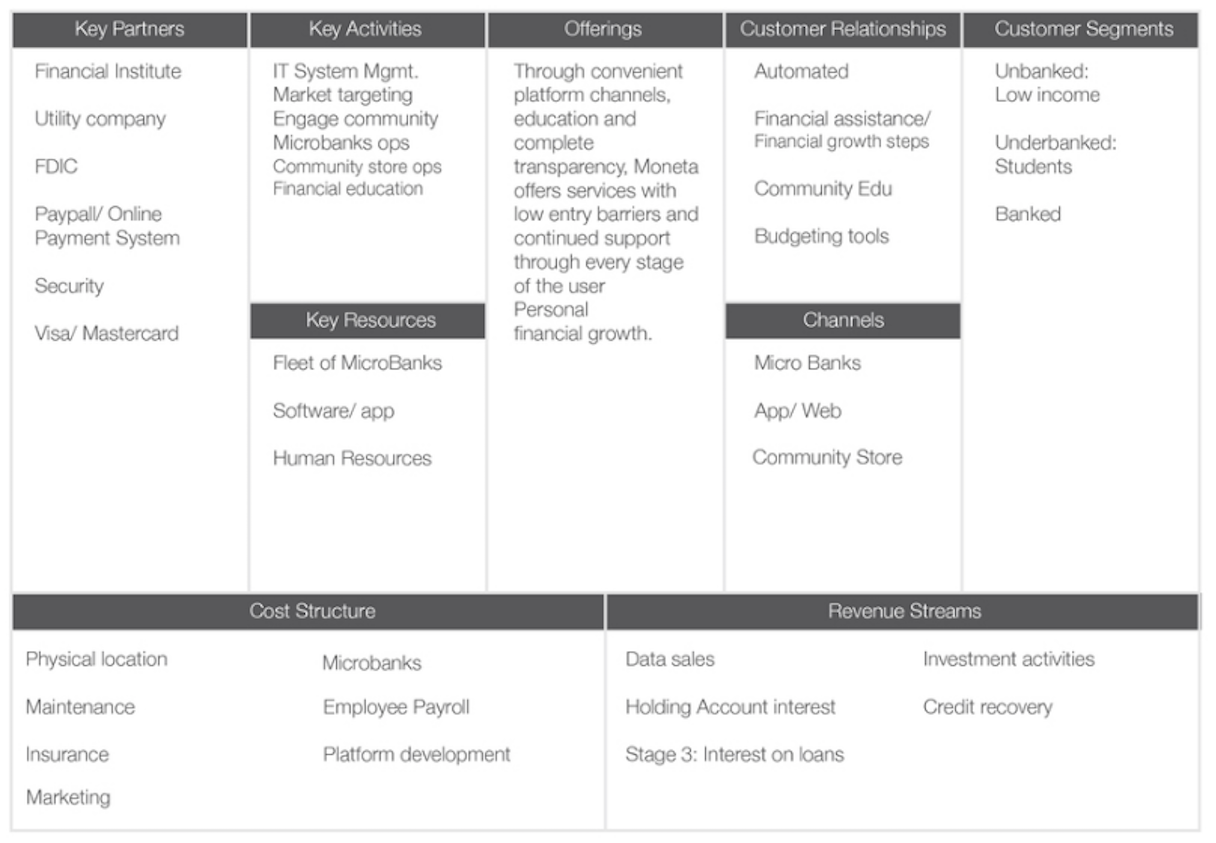

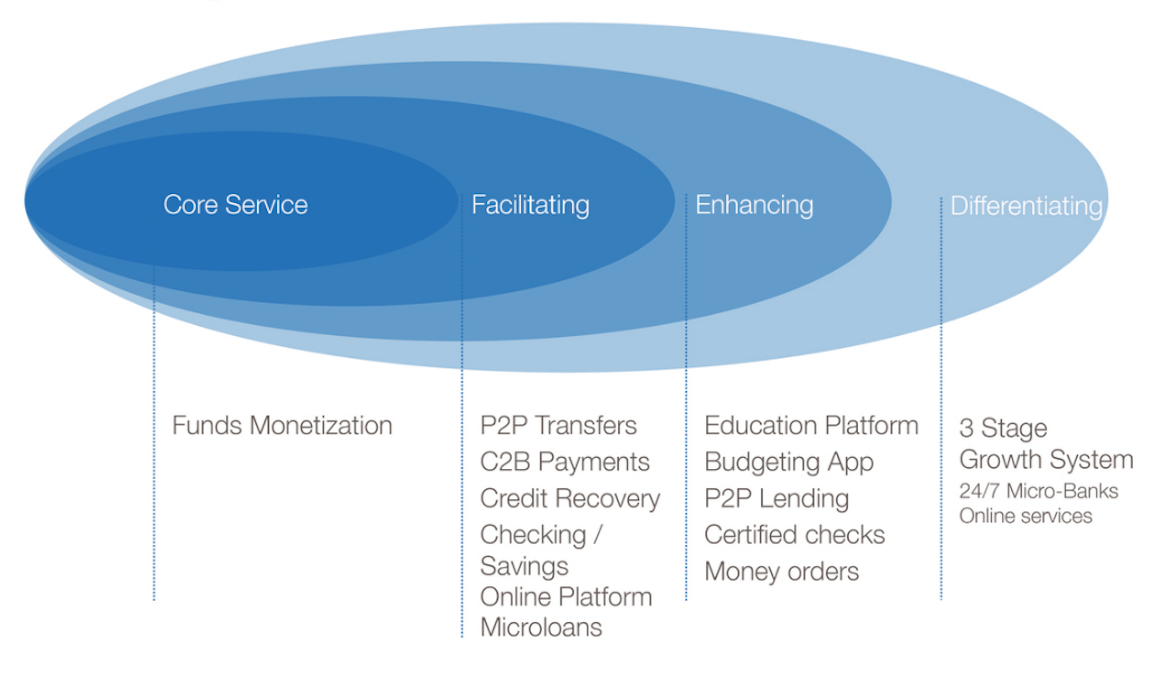

Service Package

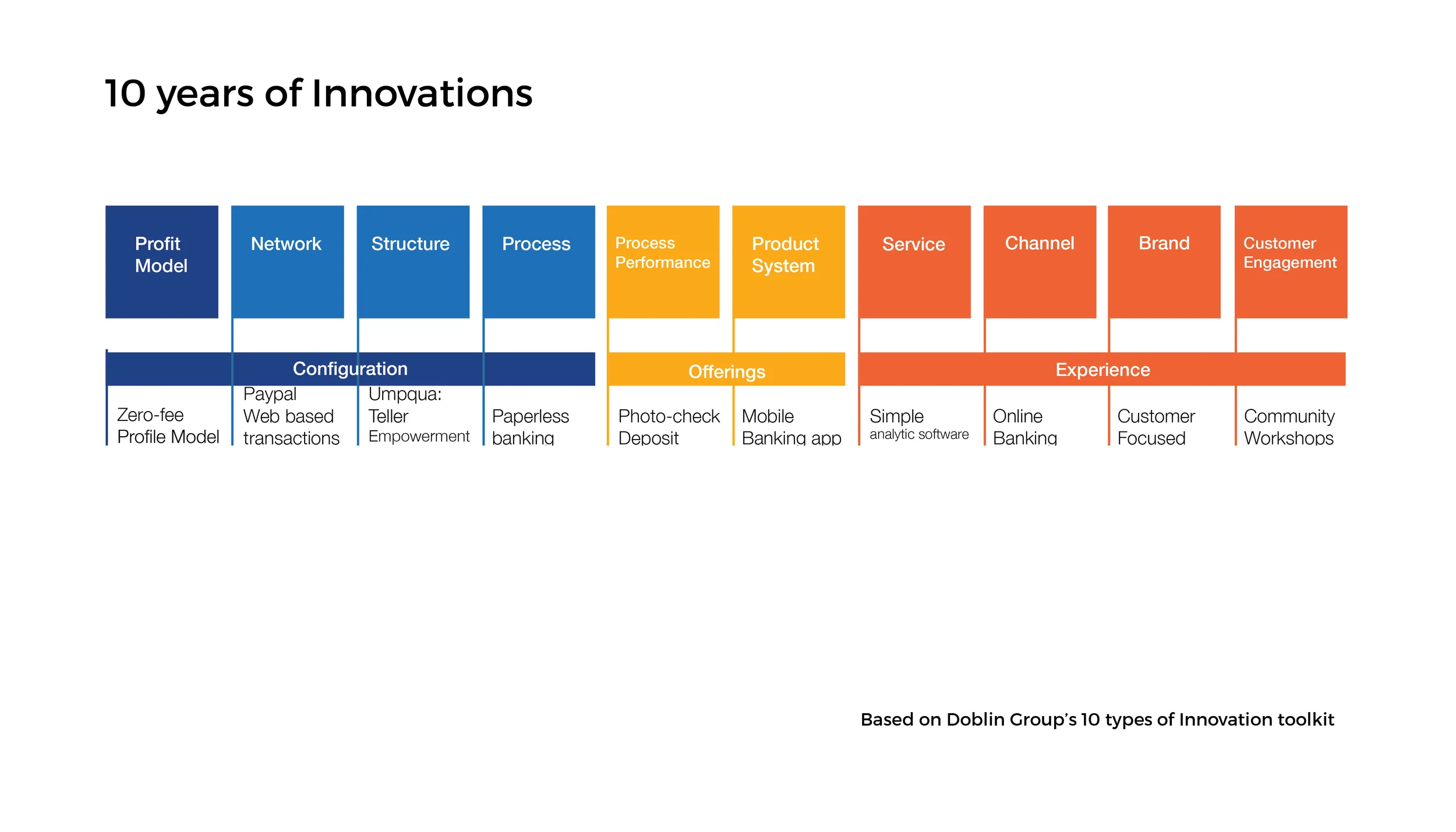

Ten Types of Innovation by Doblin Group: 10 years of Innovation in Financial Services to gain a better understanding of the history of the financial services sector.

SWOT Analysis

Business Model Canvas

Defining Insights: Persona Development & Innovation Space

Based on our research we developed our personas. Each persona represents a part of Moneta's target audience.

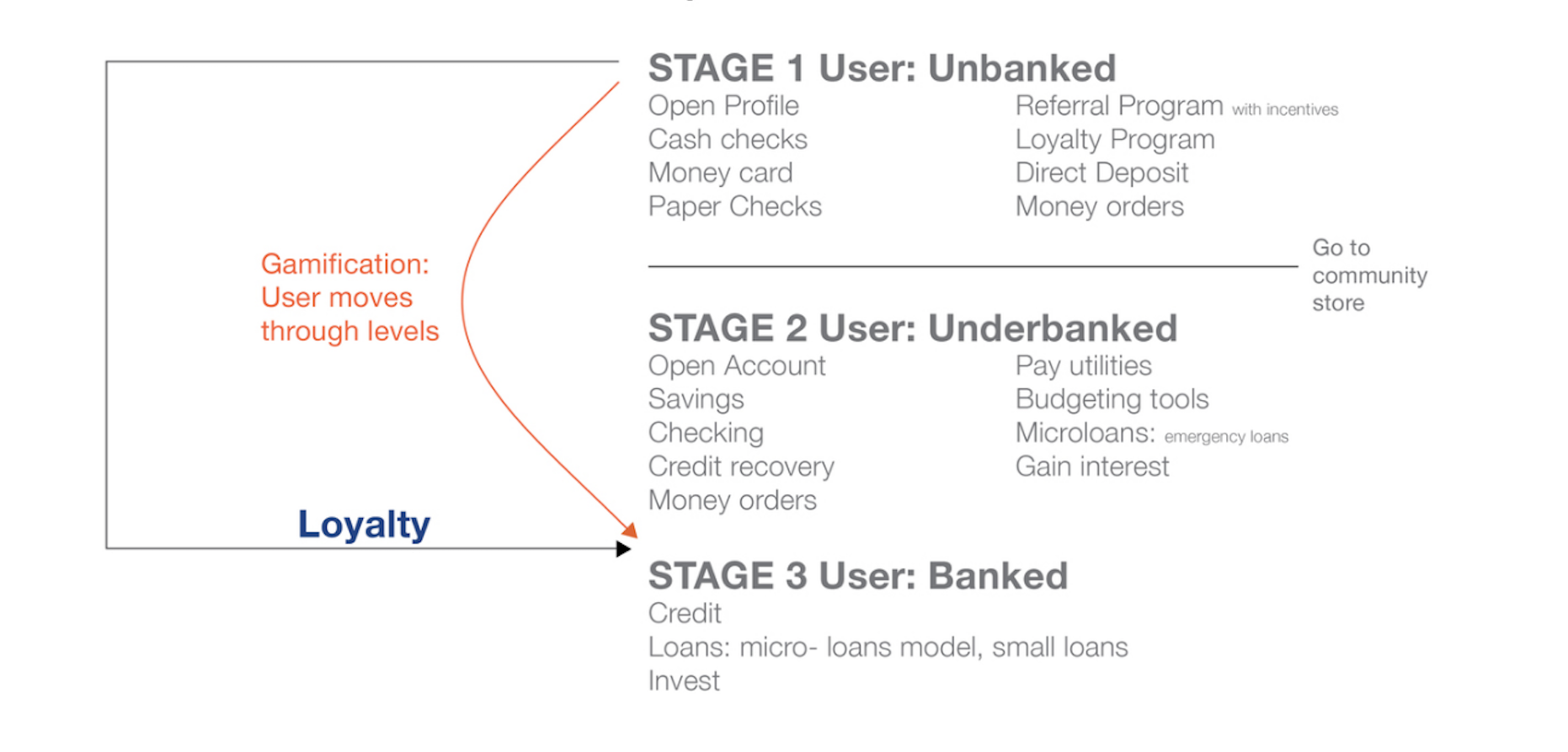

Will Johnson: represents the unbanked population that lives from pay check to pay check.

Janet Silber: represents the underbanked population. She's considered underbanked because she uses basic banking functions but does not have a savings account.

Stephan Rogers: represents the banked population. Low risk investments are something that interest Stephan because he is financially stable but would like to expand his business.

Developing Ideas

Moneta’s principal objective is the disruption of predatory lending practices through convenient platform channels, education and complete transparency.

Moneta offers services with low entry barriers and continued support through every stage of the user’s personal financial growth.

Service Touchpoints

Moneta delivers its services through a multitude of physical and digital channels.

MicroBank: An ATM-like touchpoint that facilitates a variety of user needs including: dispenses Moneta Cards, deposits, account or profile information, etc.

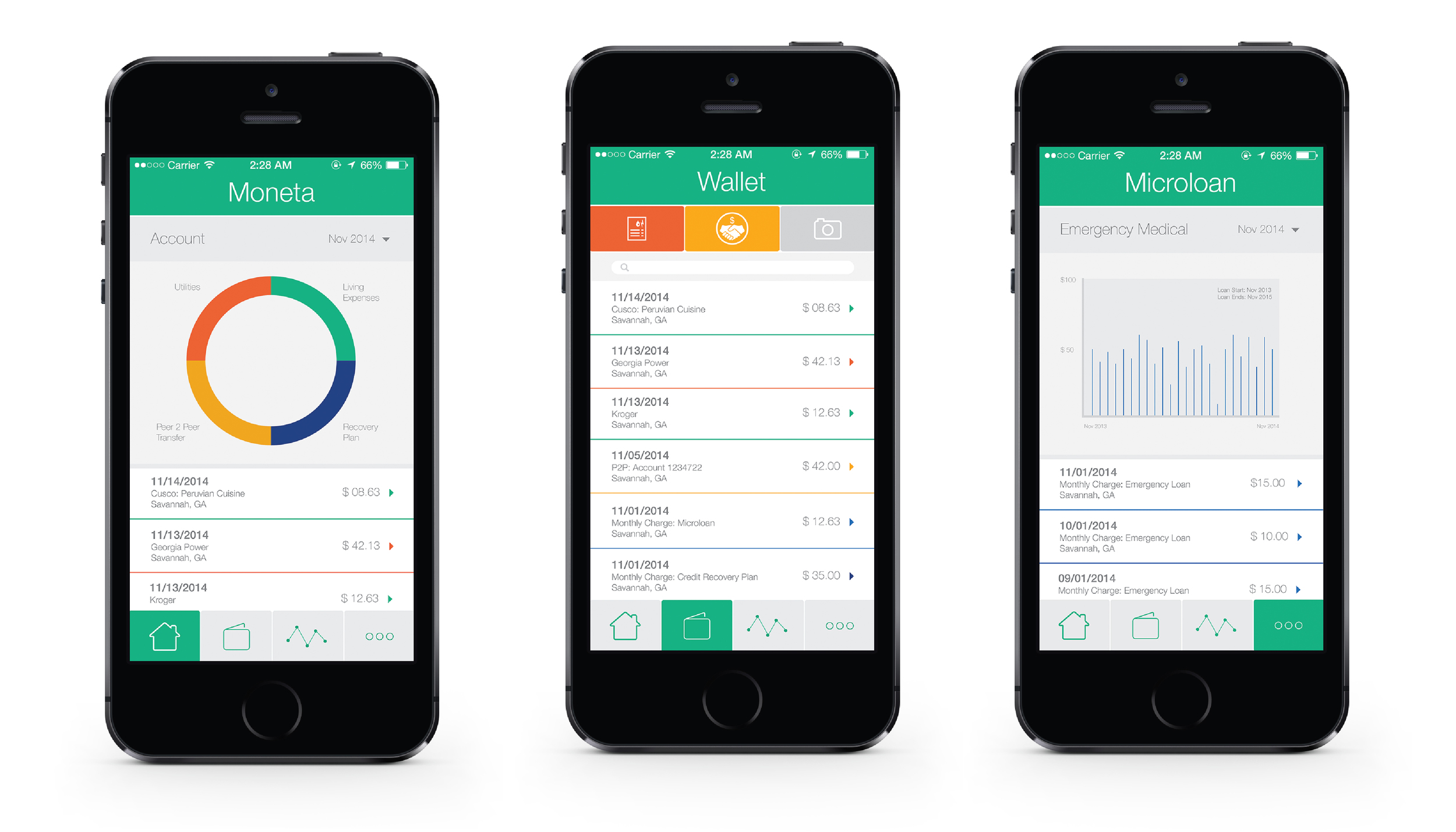

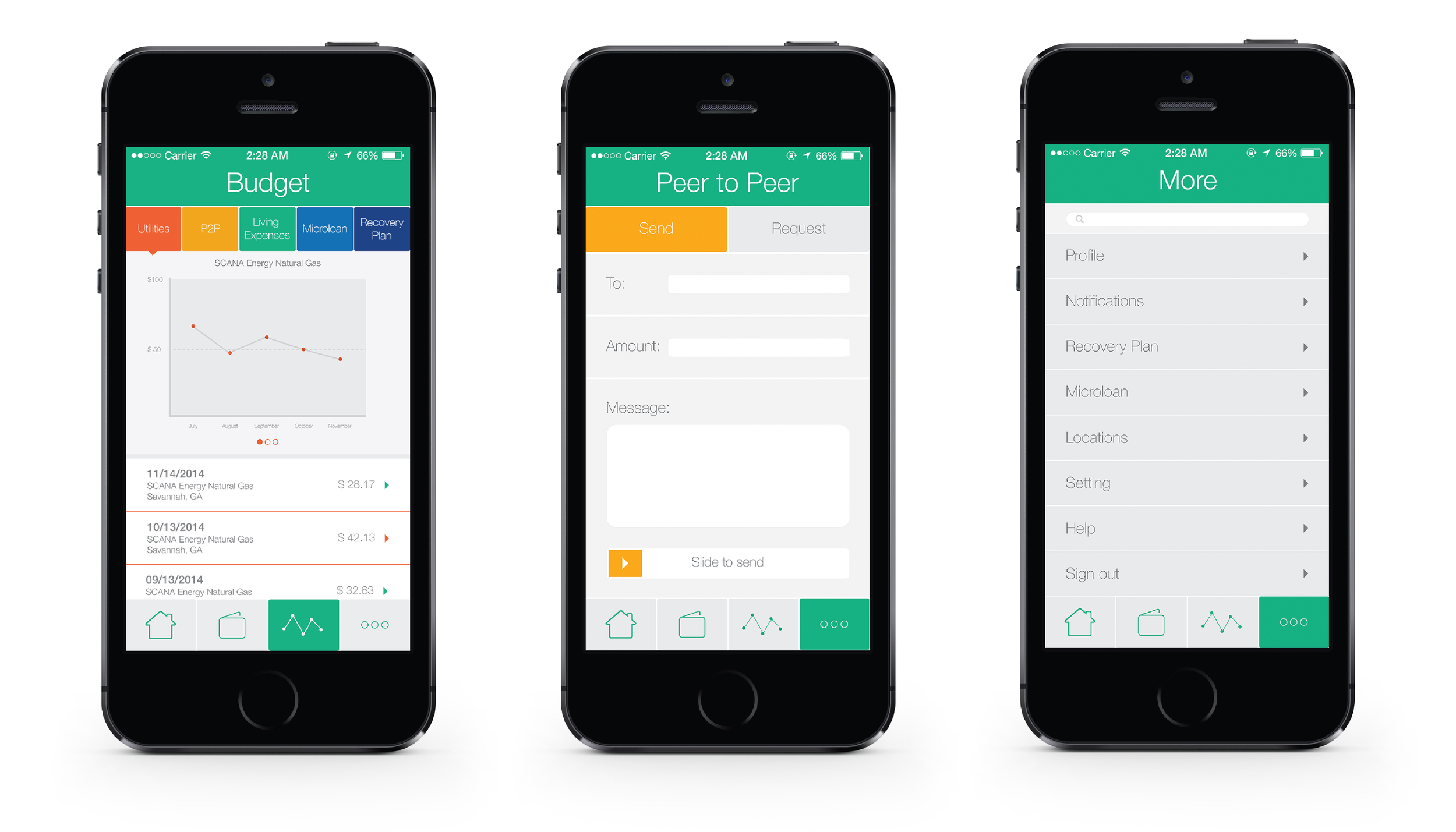

Moneta App: The Moneta Mobile Application allows users to monitor funds, access budgeting tools, change account/profile setting, among other user's needs.

Website: Moneta’s website allows for users to monitor funds, access budgeting tools, change account/profile settings and access educational tools, and schedule appointments at the community center. Also file missing card report and receive assistance with service issues.

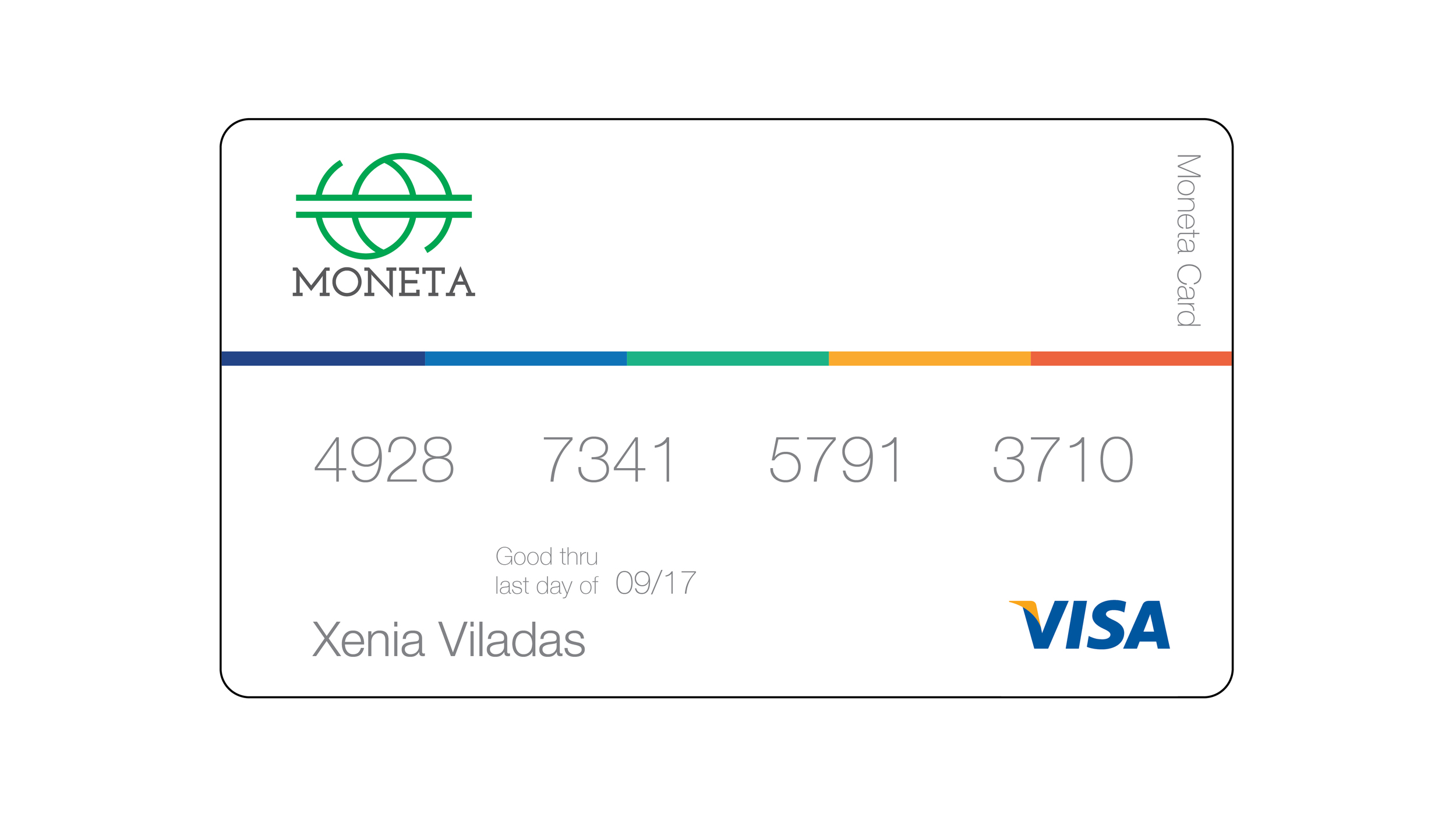

Moneta Card: Works much like a pre-paid credit card but has an attached to a user profile to allow for card replacement if lost.

Community Center: A Moneta space strategically placed in highly unbanked census tracts. They serve as a point of resource for users and facilitate all of Moneta’s services.

Call Center/ Web Chat: Serves users needs for service recovery and assists with user education.

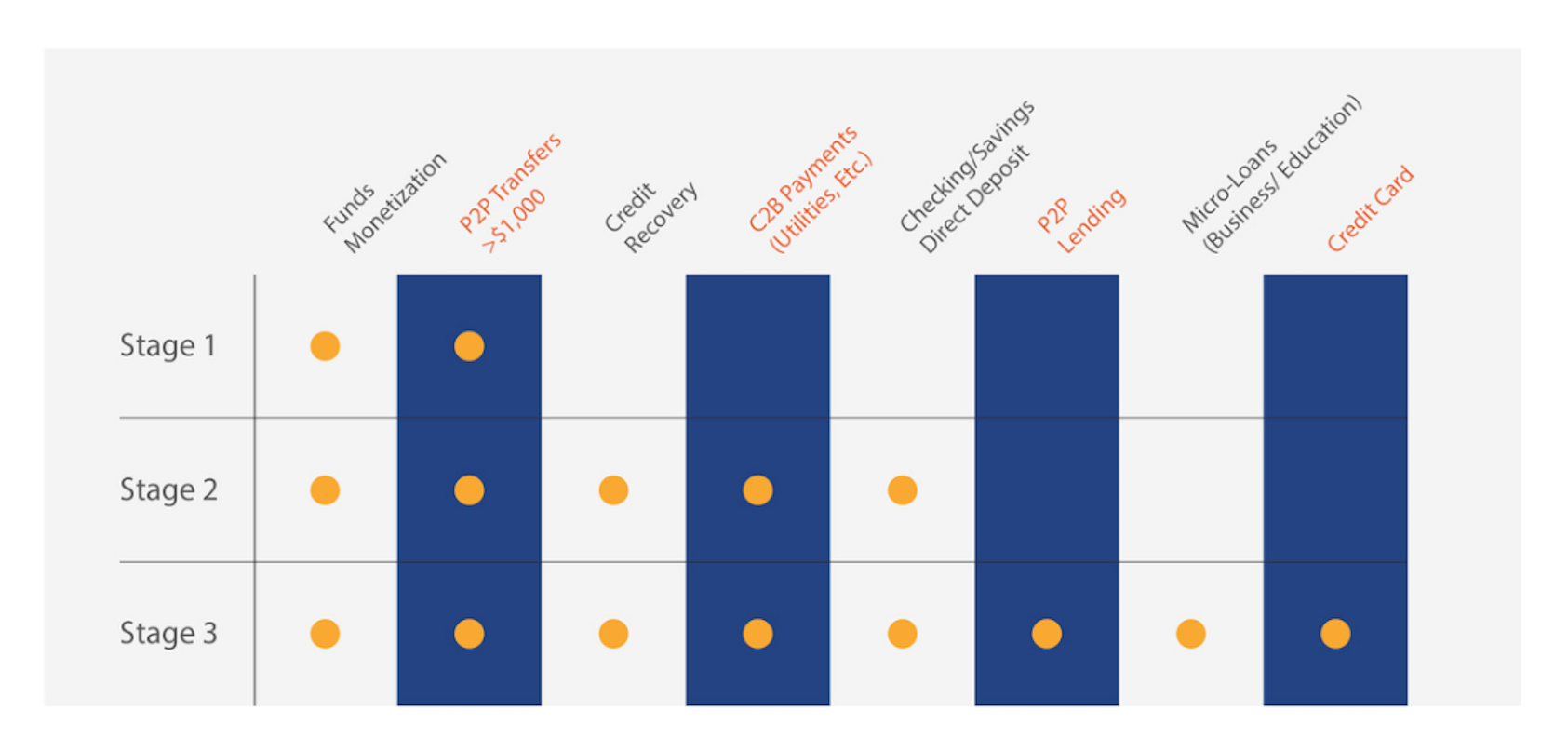

Three Stage User Growth

Moneta employs a three stage user growth system. The user growth, through the three stages, is enhanced through the use of gamification. Users begin by entering the stage that is appropriate based on their banking experience and desired services. As a user grows financially they continue through the stages and have access to expanded service offerings. Developing user trust and loyalty is of utmost importance to Moneta.

Through this gamified and transparent process, Moneta users are educated on financial services in an encouraging and engaging manner.

Three Main Service Offerings

Funds Monetization

The process of funds monetization is a core service offering at Moneta and sustainable on its own. Moneta provides a service in which the user can monetize their checks for a significantly lower percentage than alternative financial services. After creating a profile, the users can now deposit checks via mobile app or one of the Moneta microbanks.

Moneta charges 1% service fee that is placed in a holdings account.This account is interest yielding for Moneta and is a source of revenue while it is being held. Every six months Moneta’s user will gain access to the accumulated principal 1%. The users will have the option to extract the funds and use them they wish, keep them in the holding account, or open a conventional bank account with them. This process is completely transparent and introduces the concept of a savings account.

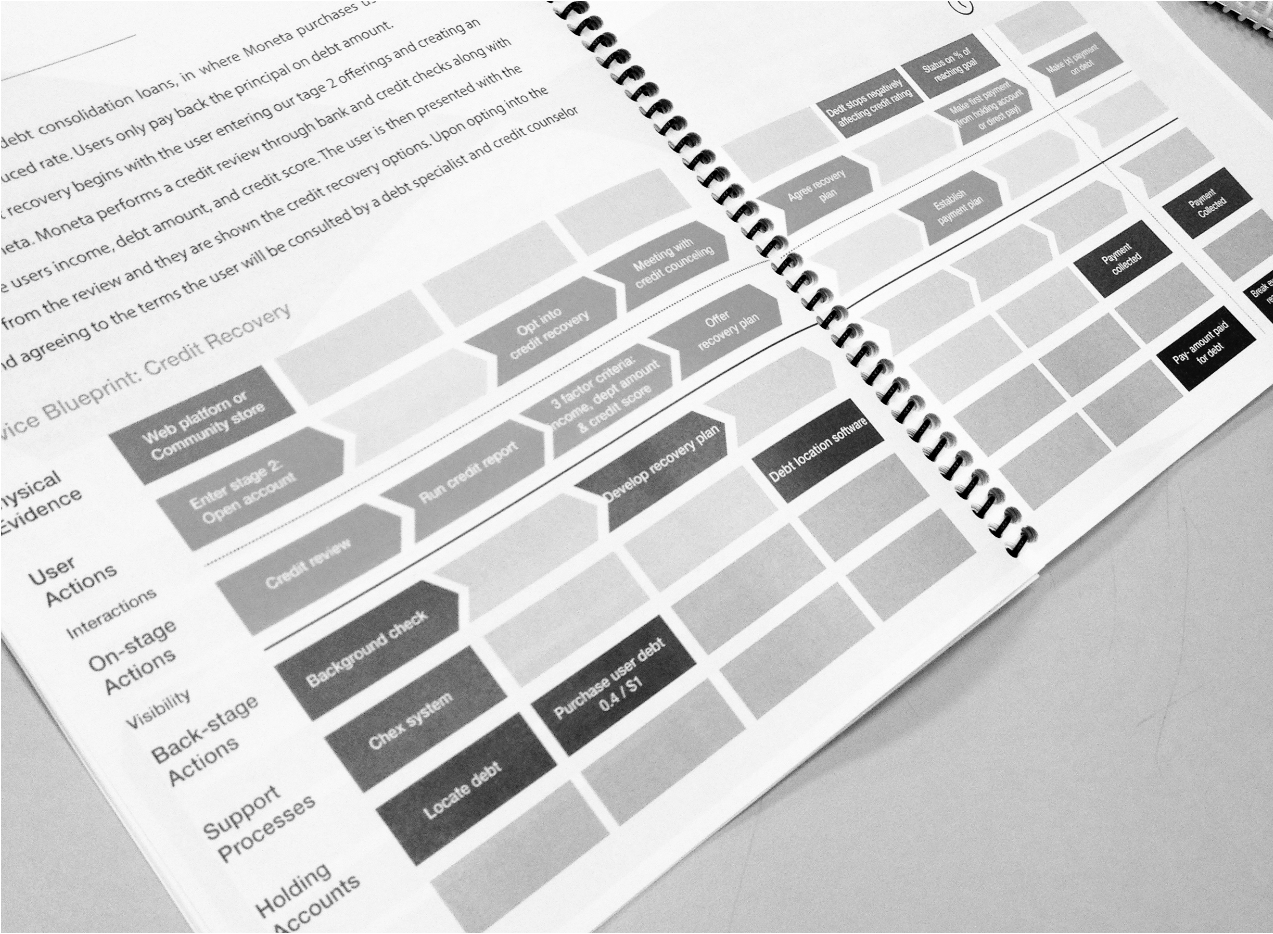

Credit Recovery

Moneta purchases the user’s debt from secondary debt collectors at a reduced rate. Users will only need to pay back the principal on debt amount.

Moneta performs a credit review and a credit check. The user is then presented with the information from the review and they are shown credit recovery options. The plan is developed while considering the user’s income, debt amount, and credit score. Upon opting into the service and agreeing to the terms the user will be consulted by a debt specialist and credit counselor to create a recovery plan. The app facilitates the user’s payment plan and visualizes a structured recovery plan.

Investment Model

Microloans are funds crowd- sourced by Moneta, lent to users for emergency loans, small business, or educational needs. Stage Three users will be encouraged to explore investment opportunities. Moneta charges the loan recipient 3% on the principal amount and provides the investors with a guarantee return of 1.5%. Moneta keeps the remaining 1.5% to cover expenses incurred during the service.

Service Touchpoints Visualization

The project is designed as an actionable business plan. As a visualisation we designed mobile first because when:

Managing either a checking or savings account, the underbanked mostly use mobile devices since 70% have mobile phones. - Board of Governors of the Federal Reserve System, “Consumers and Mobile Financial Services”, March 2014

The Moneta app

Allows users to monitor funds, access budgeting tools, change account/profile setting, access educational tools, and schedule appointments at the community center. Also monetize funds remotely and file missing card reports and receive assistance with service issues.

The Moneta Card

Works like a pre-paid credit card but has an attached to a user profile to allow for card replacement if lost and access to cash extraction at Micro Banks and conventional ATMs.